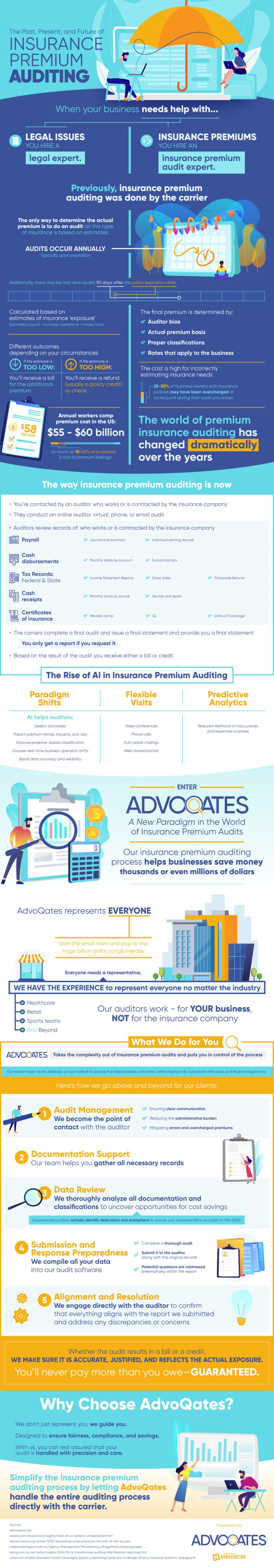

Insurance premium auditing is essential for businesses to ensure that they are paying insurance premiums that accurately reflect their risk level. This process is usually conducted on an annual basis right after the insurance policy expires. Records are collected of who works for or is contracted by the company in order to verify the accuracy of the premium that is being charged. Premiums are initially based on estimates of the company’s insurance exposure, including an evaluation of the estimated payroll, business operations, and losses divided by the experience modification factor (mod).

What Influences an Insurance Premium Audit

There are several factors that can influence the final premium amount, including auditor bias, the actual premium basis, proper classifications, and rates that apply to the business in question. Some of these factors are not completely impartial, which may result in an insurance premium estimate that is too low or high. If the estimate is too low, the company will receive a bill for the additional premium. If the estimate is too high, the company will receive a refund in the form of a policy credit or check. Unfortunately, the majority of business owners with insurance policies have been overcharged at some point in the audit process.

That’s why it is imperative to have a clear, well-documented process to verify premiums. The first step is to be contacted by an auditor who works for or is contracted by the insurance company. This audit can be carried out either online, on the phone, or by email, but the required documents are the same. This includes payroll, cash disbursements, tax records at the federal and state level, cash receipts, and certificates of insurance. All of these documents are able to provide insight into who the company is employing. After the audit is carried out, a final statement is issued in which the premium is either over- or under-charged. Depending on the outcome, the company being audited will receive either a bill or a credit.

The multi-step auditing process is still prone to fault, so artificial intelligence technology has been enlisted to assist auditors. It can help improve the accuracy of the audit by detecting anomalies and boosting data accuracy by leveraging predictive analytics. It can also help with overall process efficiency by helping to predict premium trends, impacts, and risks, and uncover real-time business operation shifts. AI is able to provide several different types of visit formats, including video conferences, phone calls, auto paper mailings, and web-based portals.

Conclusion

Some of the AI solutions currently in the auditing space provide all of these benefits and more. There is audit management, where the offered solution becomes the point of contact with the auditor, reducing the administration burden for the company. It can also offer documentation support and thorough data review to make sure all of the necessary information is gathered and correct. The support continues through the submission and resolution stages of the process, so the business is well equipped to address any discrepancies that might pop up. This additional layer ensuring precision and care in the auditing process can be extremely beneficial.

WebProNews is an iEntry Publication

WebProNews is an iEntry Publication